Understanding the Shifts Shaping Cable Manufacturing in 2025

The cable industry walked into 2025 carrying both momentum and uncertainty. Demand for power cables, data cables, EV wiring harnesses, automation cables, and specialty high-performance wires continues to climb globally—but the price landscape looks very different from what factories experienced over the past two years.

As raw materials fluctuate, global logistics reorganize, and OEM requirements tighten, cable factories are facing a harder question:

How do we maintain profitability while keeping delivery stability in a volatile supply chain?

This report consolidates real-world factory observations, procurement behavior trends, and upstream-downstream market signals to give cable manufacturers a clearer forecast for 2025.

1. Raw Material Price Trends: Copper, Aluminum & Polymers

Copper: Expect High-Level Fluctuations, Not a Crash

Copper prices remain the single strongest driver of cable cost. In 2025, analysts are observing:

Strong demand from renewable energy and EV charging projects

Reduced mining output from key regions

Persistent financial speculation in commodity markets

Most trading desks expect copper to stay at a historically high range, with short-term volatility but no major downward collapse. For cable factories, this means:

Tighter cashflow pressure

More need for pre-purchase locking

Higher operating risk for long delivery orders

Aluminum: More Stable but Rising in Q2–Q3

Aluminum demand is strengthened by lightweight automotive applications and high-voltage transmission cables. Prices are rising moderately due to energy costs and refinery limitations.

PVC, XLPE, TPE, TPU: Polymer Costs Increasing

Driven by petroleum price increases and the tightening of environmental regulations, polymer suppliers have issued multiple price adjustments.

Impact on cable manufacturers:

XLPE and halogen-free compounds see the highest increases

General PVC remains affordable but with higher MOQ pressure

Lead times from compound manufacturers extend by 15–25%

2. Global Demand Outlook: What Sectors Are Driving Cable Consumption?

1) Renewable Energy & Power Infrastructure – The Strongest Driver

Solar farms, wind projects, and grid modernization lead global cable demand growth. High-voltage and medium-voltage cables remain core, but data cables and control cables in monitoring systems also show strong expansion.

2) Automotive & EV – High Growth but High Requirements

EV wiring harness products are growing, but OEMs increasingly demand:

Smaller conductor diameter tolerances

Higher temperature resistance

Better shielding for high-frequency noise

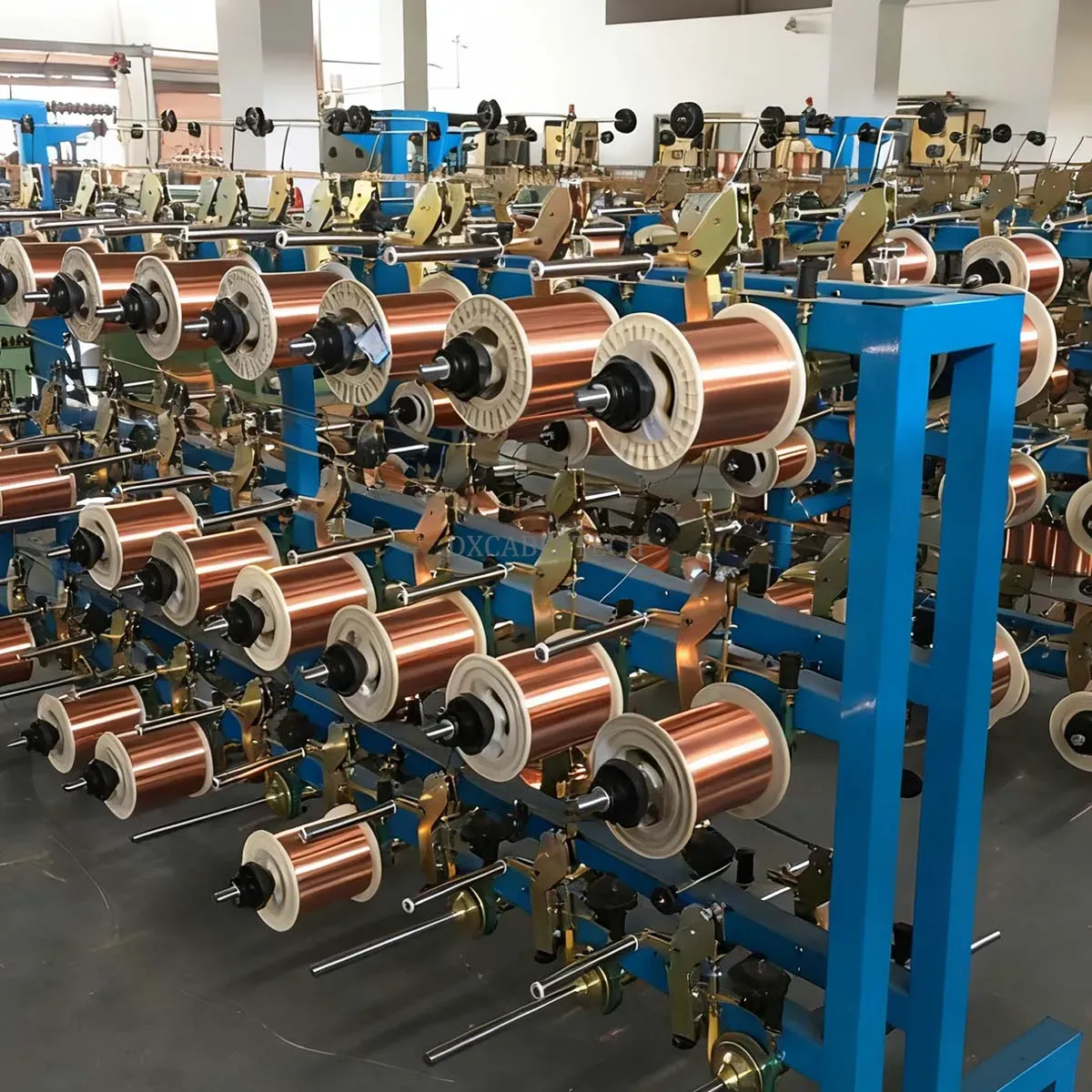

This pushes factories toward more advanced extruder lines, precision payoffs, and stable stranding.

3) Data & Communication – Steady Expansion

USB-C, high-speed LAN, and industrial Ethernet cables continue increasing with digitalization and 5G deployment. Shielding performance and line speed consistency are becoming more critical.

4) Household Appliance & Consumer Electronics – Stable but Lower Margin

Demand is steady, but competition is extremely price-driven.

3. Supply Chain Pressure: Where Costs Are Rising in 2025

Logistics

While shipping prices are more stable than in 2021–2023, geopolitical risks continue affecting routes. Factories must account for:

Temporary port congestion

Re-routing delays

Increasing freight insurance fees

Manufacturing Equipment & Spare Parts

More factories are upgrading equipment to maintain tolerance and meet global requirements. As a result:

Delivery time for extrusion tooling, capstans, and sensors increases

Spare parts ordering cycle becomes longer

Automation equipment prices rise due to component costs

Labor Costs

Most cable-producing regions report wage increases between 8–12%, pushing manufacturers toward higher automation adoption.

4. Pricing Behavior in 2025: What Cable Buyers Are Doing Differently

1) Shorter Lock-in Cycles

Buyers avoid long-term fixed-price agreements due to copper volatility.

2) Stricter Quality Control Before Mass Orders

More buyers now request:

Detailed process reports

Stranding consistency data

Insulation concentricity measurement

Shield coverage test reports

Factories lacking standardized QC lose competitiveness.

3) Supplier Diversification

Large overseas buyers no longer rely on a single factory, increasing pressure on mid-sized cable plants.

5. How Cable Factories Can Reduce Risk in 2025

(1) Upgrade Equipment for Lower Waste and Higher Stability

In a high-cost environment, waste reduction = direct profit.

Factories benefit from upgrading:

High-precision extruder lines (better plasticization, stable diameter)

Digital stranding machines for uniform tension

High-speed coiling machines with intelligent tension control

Even a 2–3% material saving becomes significant in large-scale production.

(2) Strengthen QC Documentation

Factories with traceable QC data receive more international orders.

Key areas include:

Diameter control curves

Insulation/taping overlap accuracy

Shield braid density

Conductor lay length stability

(3) Build a Multi-supplier Raw Material Network

Avoid heavy dependence on a single copper rod, PVC, or compound supplier.

(4) Adopt Flexible Pricing Models

More factories now offer:

LME-linked copper pricing

Monthly adjustment contracts

Tiered pricing for long-cycle orders

These models reduce conflict with buyers and prevent margin loss.

6. Market Forecast: What Happens Next?

The second half of 2025 is expected to bring:

Stable but elevated copper prices

Rising demand in renewable energy, EV, and telecom

Higher production standards imposed by global OEMs

Acceleration of automation and digitalization in factories

For cable plants, the winners will be those who:

Control their production cost with efficient equipment

Maintain high consistency and traceability

Build resilient supply chains

Upgrade old machinery to meet global standards

Final Thoughts

2025 is not a year of “cheap cables”—it is a year of smarter production, tighter QC, and more strategic supply-chain planning.

Manufacturers that modernize their production lines, improve precision, and strengthen traceability will gain a clear advantage in the global market.

Explore the complete cable manufacturing system:

→ Cable Manufacturing Process & Equipment Guide